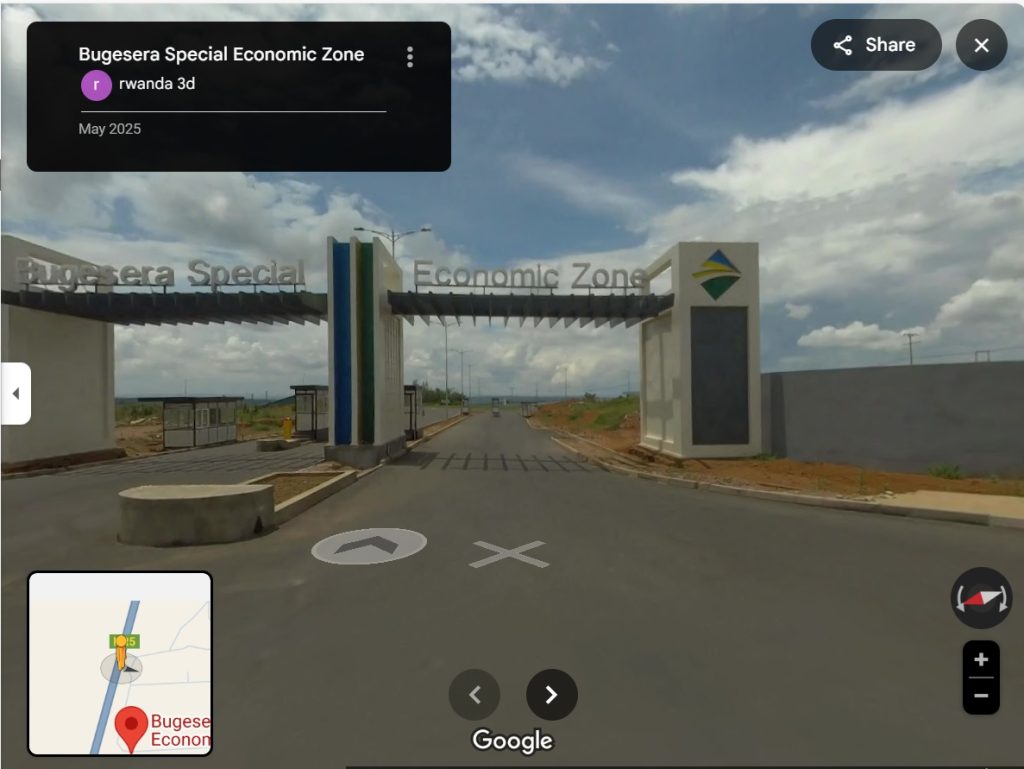

The most competitive zone to establish and grow your business in Rwanda

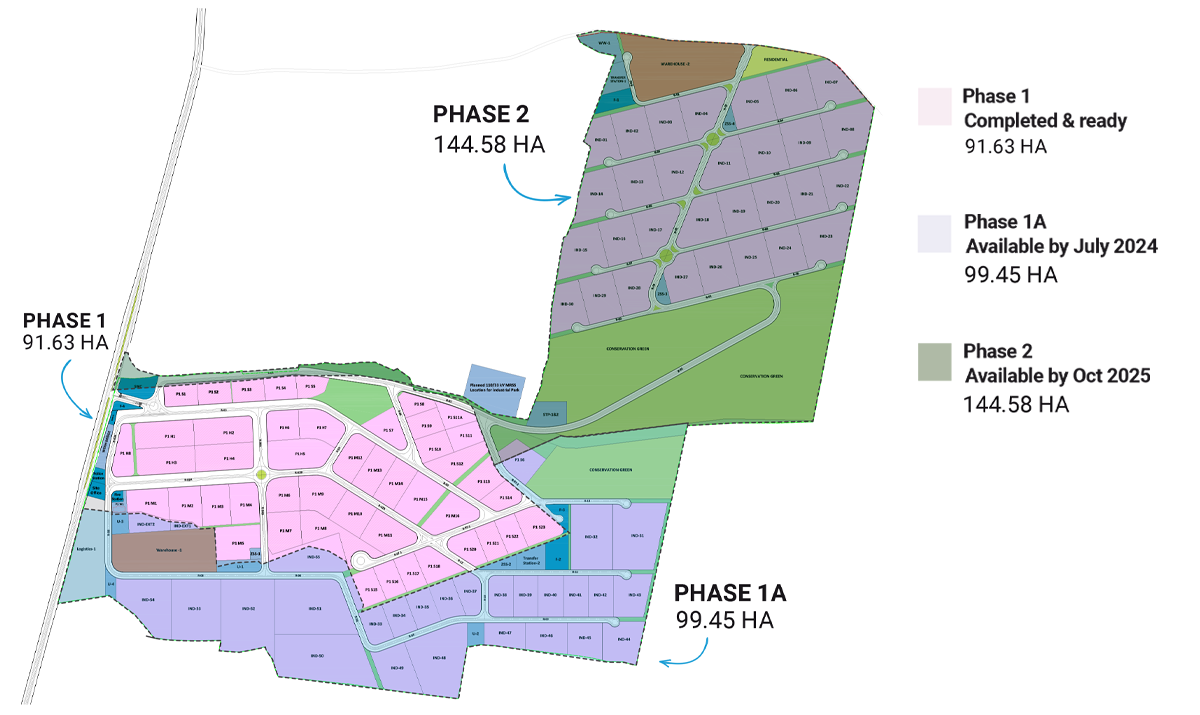

Bugesera Special Economic Zone (BSEZ), located in the Bugesera district of Rwanda – is a Public-Private Partnership (PPP) agreement between Arise IIP and the Government of Rwanda with a committed investment of USD 100 million.

Our zone is committed to the development of a more competitive economy by unlocking the country’s industrial potential. We seek to transform Rwanda into a regional manufacturing powerhouse within the continent, while leveraging its carbon endowment in the pursuit of green growth.